Stock & Other Securities

Stock and Mutual Fund Shares

Did you know that gifts of stock can give you a tax benefit even in a fluctuating market? These gifts can reduce the capital gains you would pay without changing your portfolio.

Donating a charitable gift of stock or mutual fund shares is a great way to improve the lives of those with Parkinson’s disease and receive an end-of-the-year tax deduction. Some of the most favorable tax benefits are generated by contributions of appreciated, long-term, capital-gain securities.

You can donate shares of stock directly to a nonprofit of your choice or choose to liquidate the stock into a Donor Advised Fund and issue donations, called grants, from that account.

In addition to receiving a charitable deduction for the full, fair market value of such a gift, the donor does not pay any potential tax on the capital-gains of the gift and any sales commission that would be payable upon the sale of the assets.

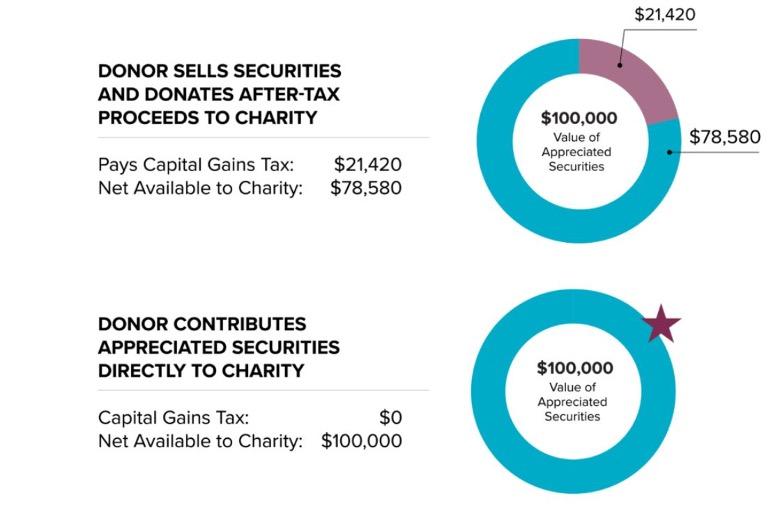

The example below illustrates a donor with $100,000 in long-term appreciated stock and an original cost-basis purchase price of $10,000:

By donating the stock, this donor would have more available to give and less to pay in taxes. This strategy can allow donors to donate 20% more to the causes they care about!

Note: this illustration example assumes a 35% income tax rate, a federal long-term capital gains rate of 20%, and a Medicare surtax of 3.8%. This does not include any additional state taxes.

Many of our supporters choose to take advantage of this especially smart way to give.

Already made a gift of stock or other securities?

Please notify us! It is possible that the financial institution will not share your information with us. Please send a note at DonorServices@Parkinson.org or fill out this form when you have requested a stock transfer from your financial institution, so we can make sure to thank you and ensure that your gift goes where it is intended.

The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. References to estate and income taxes include federal taxes only. State income/estate taxes or state law may impact your benefits.